Subscribe to the newsletter:

Investing money. Often seems like something rather risky, scary and extremely complicated. History books still talk about the epic Stock Market Crash of 1929 and most of us have lived through the crisis of 2008. However, many of the ideas about investing money may be outdated, or just plain wrong. The advantages of investing are numerous, from having money saved up for the future or retirement to being able to make some extra cash or even start your own business. Check out some of the most common misconceptions about investing.

There are several innovators working to make investment accessible, simple and fun. In the Netherlands, Robeco is one of the most successful assessment management firms and now they are actively trying to find even more innovators committed to changing this paradigm.

1. Investing is too complicated

Equity capital, trust, mutual fund, liability, margin, blue chip, derivative and index trackers are only some of the words associated with investing. No wonder people usually believe it is something extremely complicated and maybe even impossible to understand. Research has even show that 66% of people aged 18 to 29 and 65% of those 30 to 39 say investing in the stock market is scary or intimidating, opinion also shared by 58% of those aged 40 to 54 and 57% of those 55 and older.

However, investing does not need to be that complicated and with the help of apps such as Bux, it is made simple, fun and accessible to anyone. Bux is an app that promises to take the complexity out of the financial markets. They offer free practice and affordable trading in their app. It is also made fun, Bux offers players the chance to play games such as challenging each other on how stocks might perform and the opportunity to go from playing for points to betting actual money.

Gamifying apps that make investment simple are each time more present in the market and that is exactly one of the things Robeco is looking for, they want to make investment more fun and easier to understand.

2. You need a lot of money to invest

You need to have money to make money. That is what most people believe in, that investing is only for those with a lot of money. That could not be further from the truth. Semmie, for instance, is an app that wants to prove investing money is accessible to all, including those without knowledge of investing and with a limited budget.

You can start investing with only 50 euros a month and they have a long-term vision and invest only in sustainable funds. Using artificial intelligence, they have a risk-averse way of investing, and claim they try to achieve a steady return for their customers every year.

FIND OUT FIRST ABOUT OUR ANNOUNCEMENTS AND EVENTS

3. It’s only for men

It is often said women are more risk averse than men and that they lack the skills or knowledge to do so. However, it has been proven that not only do women consistently earn higher returns than men (by 40 basis points on average), they were also able to add more to their account balances over time (12.4 percent compared to 11.6 percent ), according to a study by Fidelity.

Unfortunately, what is still true is that women invest a lot less than men, in average 40%. But there are innovators working to change that. Ellevest is a platform made specifically to help women invest. They want to close the investment gap, right now 86% of Investment advisors are men, with an average age of 50 or more.

They help women by calculating financial goal targets to meet their specific needs, including a larger retirement target amount for their longer lifespan, they also suggest how much to contribute based on the financial profile, a gender-specific salary curve and goal targets. Not to mention the use of insights on your finances and gender to build investment portfolios to help you reach women’s goals or better in 70% of markets.

4. The younger generation doesn’t care about saving

The younger generation, in particular millennials, are usually seen as averse to saving money and eager to spend. Not only is that not true, it is, in fact, quite the opposite. According to recent studies, 71% of millennials are saving for the future and 39% of them are even described as “super savers”, which means they save more than 10% of their salaries.

Although most millennials find investment quite scary and intimidating, they are way ahead of the game when it comes to bitcoin, for instance. A big percentage of this group believes it is the best way to save, and it is now creating jobs, inspiring entrepreneurs to create startups, and spawning hundreds of crypto-tokens with unique functions and development.

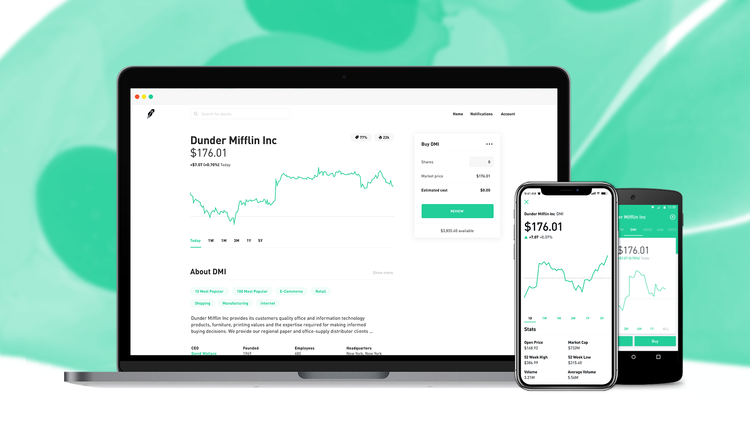

Investing in bitcoin may seem even more complicated than investing in the stock market, especially for those unfamiliar with the concept. Apps like Robinhood are here to make it possible for everyone to invest. They allow the user to learn about the stock market and make investments there, but they also have a cryptocurrency platform. Their app brings together cryptocurrency and stock, and it is a secure investment platform, without fees to open or maintain an account.

5. Investment is too risky

Another very common misconception about investing, probably spread by Hollywood movies, is that investment is too risky and you can lose all your money. Indeed that can be true, the more you invest the more you can lose. But it can also be risky not to invest, because an early strategy of consistent investment can provide nest egg later on in life that can be used for major purchases or retirement.

There are many options for those who do not want to or are too scared to invest a lot of money, like Acorns, which allows users to invest their spare change. Once linked to a credit or debit card or PayPal account, Acorns rounds up purchases to the nearest dollar and invests the difference in one of five diversified exchange-traded fund portfolios.

6. It’s a self-involved activity

“Let me tell you something. There’s no nobility in poverty. I’ve been a rich man and I’ve been a poor man. And I choose rich every time”. Quotes like this one from the Jordan Belfort, the Wolf of Wall Street, make people associate investments with narcissism, and see it as an activity that only brings profit to oneself and not to others. That is not at all true, there are several platforms that allow user to invest in a socially responsible way.

Swell, for example, is an online investing platform designed for socially responsible investors. They provide consumers with a way of investing in companies that have a positive impact in the world. They have created six portfolios with socially responsible themes, such as renewable energy, zero waste and clean water and companies are listed in each one of these. Portfolios are rebalanced quarterly.

Robeco wants to change the way people perceive investment and is looking for promising innovators with solutions to make investment services more attractive, fun and simple. They want innovative solutions in the fields of gamified investment platforms, referral marketing tools and tools for specific groups. Innovate the future of investment services with Robeco.